LeAsing Market

Analysis

Leasing is an effective tool for updating fixed assets and is actively used in the world practice. In Kazakhstan, leasing activities are regulated by the Kazakhstan Law “On Financial Leasing” dated July 5, 2000, No. 78-II, the Kazakhstan Civil Code (Special Part) and the Kazakhstan Code “On Taxes and Other Obligatory Payments to the Budget (Tax Code)".

According to the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan in 2023, the total value of financial leasing agreements amounted to 756.7 billion KZT and, if compared to 20211, the increase was 158.4%.

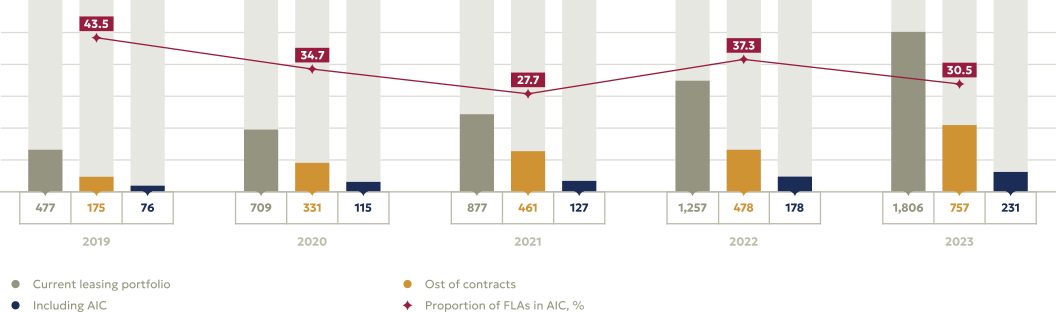

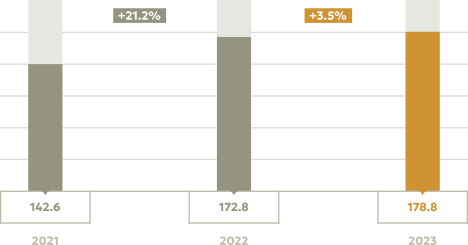

Key Leasing Indicators in Kazakhstan, bln kzt

The most attractive industries were agriculture, forestry and fisheries – 30.5% of the total value of financial leasing agreements, transport and warehousing – 39.3% and manufacturing – 15.7%.

At the same time, the leasing portfolio in the republic as a whole at the end of 2023 amounted to 1,806.5 billion KZT, and the volume of lease payments received on financial leasing reached 457.8 billion KZT.

1At the same time, the leasing portfolio in the republic as a whole at the end of 2023 amounted to 1,806.5 billion KZT, and the volume of lease payments received on financial leasing reached 457.8 billion KZT.

Number (units) and the cost of contracts (billion KZT) in the areas of use of financial leasing:

| Kazakhstan | Agriculture, forestry and fisheries |

|||

| amount | quantity | amount | quantity | |

| Vehicles and equipment | 416.1 | 3,133 | 1 | 17 |

| Other machinery and equipment | 340.2 | 8,509 | 230.2 | 8,264 |

| of these, machines for agriculture and forestry | 230.4 | 8,266 | 230.2 | 8,264 |

| Other fixed assets | 0.4 | 3 | ||

| Total | 756.7 | 11,645 | 231.2 | 8,281 |

The Company

is the main agricultural

machinery lessor.

7,710

In 2023, the Company leased 7,710 units of equipment in the amount of 177.9 billion KZT (under financial leasing agreements), their share is 77.3% of the total volume of leasing in the agro-industrial complex in Kazakhstan.

Thus, during its activity from January 1, 2000 to January 1, 2024, the purchase of more than 79 thousand units of agricultural machinery and equipment for a total amount of 1,243 billion KZT was financed. The leased equipment processes 15 million ha of cultivated land.

Subsidizing interest rates under a number of government programs has become the best driver for SME business growth. At the same time, the Company participates in the implementation of the following state programs (the administrator of these programs is the Kazakhstan Ministry of Agriculture):

- subsidizing interest rates for lending to the agro-industrial complex entities, as well as leasing for the purchase of agricultural animals, machinery and technological equipment;

- subsidizing the reimbursement of part of the costs incurred by the agro-industrial complex entity in case of investment.

Currently, 10 leasing companies are engaged in leasing of agricultural machinery and equipment:

- KazAgroFinance JSC

- Industrial Development Fund JSC

- TechnoLeasing LLP

- Halyk Leasing JSC

- Halyk Leasing JSC

- NUR LEASING Leasing Company

- Kazakhstan Ijara Company JSC (KIC)

- ComTransLeasing LLP

- Subsidiary of Bank Center Credit JSC

- Expert-leasing LLP.

Due to the wide distribution of state support tools, the leasing market in Kazakhstan is showing stable growth. Companies that have special programs for leasing agricultural machinery and equipment offer the following financing conditions:

| Leasing companies | Asset financing | Conditions | ||

| Financing period | Interest rate | Co-financing | ||

| Industrial Development Fund JSC | Equipment for the manufacturing industry, domestically produced | 3-10 years | 3% (from 50 million to 5 billion KZT for light industry projects) | not less than 15% |

| 9% (from 80 million to 20 billion KZT) | ||||

| TechnoLeasing LLP | Agricultural machinery and equipment | 3-5 years | from 22.25% | from 20% |

| Under the DAMU program (agricultural machinery, road construction equipment and special equipment for lease) | up to 7 years | no more than 19.5% | from 30% | |

| Halyk Leasing JSC | Agricultural machinery | up to 5 years | 24.25% (at least the base rate of the National Bank of Kazakhstan +7.5%) (for the client – 6% of the MoA) | from 20% |

| Equipment | up to 5 years | 19.5% | from 20% | |

| Halyk Leasing JSC Leasing group | Special equipment (including agricultural machinery), freight transport and cars | up to 5 years | from 20% per annum (from the base rate of the National Bank of Kazakhstan +5%) | from 20% |

| Subsidiary of Nurbank JSC Nur Leasing Leasing Company (NUR LEASING) | Leasing of trucks, special equipment, equipment, production complexes, etc. | from 3 years | from 19.75% | from 20% |

| Under the DAMU program | up to 7 years | 19% per annum | from 20% | |

| Kazakhstan Ijara Company JSC (KIC LEASING) | Harvesting machines, sowing machines, irrigation machines | from 3 and above | individually | from 20% |

| ComTransLeasing LLP | Leasing for Belarus tractors | up to 5 years | 23% | from 25% |

| Center Leasing Leasing Company LLP Subsidiary of Bank Center Credit JSC | Agricultural machinery | up to 5 years | 20,25% | 25% |

| Expert-leasing LLP | Agricultural machinery | from 3 years | 19.5% per annum (at least the base rate of the National Bank of Kazakhstan +5%) | not less than 20% |

Source: Internet resources of companies

Operating

Results

Funded clients

in 2023

1,406.3 bln KZT Invested

in the AIC from 2000 to 2023

Operating Results

| 2022 | 2023 | Dynamics | |||

| Amount of Financing | 172.8 Bln KZT | 178.8* Bln KZT | 3.5% | ||

| Quantity of Machinery | 6,806 units | 7,710 units | 13,3% | ||

| Including KZ Machinery | 4,250 units | 4,142 units | 2.5% | ||

| Loan Portfolio | 423 Bln KZT | 477.9 Bln KZT | 13.0% | ||

| NPL 90+ | 8.17% | 8.13% | 0.5% | ||

| Provisions | 10.36% | 10.85% | 0.5% | ||

| Quantity of Clients | 10,983 AP | 13,234 AP | 20.5% |

* Amount is calculated using the cash method

From 2009 to 2016, KazAgroFinance acted as an operator for financing investment projects, including those implemented at the expense of the NF RK. Since 2017, the Company has been concentrating its activities particularly on leasing of agricultural machinery.

Investment Dynamics in 2020-2023, bln KZT

1,405.5

From 2000 to 2023, the Company invested about 1,405.5 billion KZT in the AIC, including equipment leasing and loans, under previously financed investment projects.

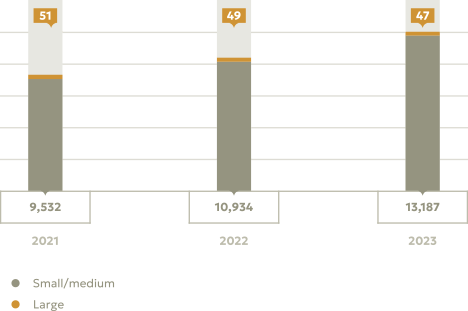

Dynamics of Quantitative Indicators of the Company, units

| Name of equipment |

2021 | 2022 | 2023 | Total 2000-2023 | ||||

| unit | amount, mln KZT |

unit | amount, mln KZT |

unit | amount, mln KZT |

unit | amount, mln KZT |

|

| Sowing machines | 258 | 10,515 | 190 | 8,547 | 191 | 8,017 | 2,168 | 76,859 |

| Tractors | 2,431 | 45,521 | 2,896 | 65,308 | 2,846 | 63,689 | 24,597 | 268,477 |

| Combines | 633 | 44,408 | 507 | 57,375 | 512 | 55,946 | 13,030 | 388,176 |

| Seeders | 258 | 7,513 | 283 | 9,251 | 172 | 6,478 | 3,654 | 40,058 |

| Other machinery | 3,696 | 33,669 | 2,930 | 32,355 | 3,989 | 43,858 | 32,687 | 194,229 |

| Equipment | 604 | 58,897 | ||||||

| Equipment | 7,276 | 141,626 | 6,806 | 172,836 | 7,710 | 177,988 | 76,740 | 1,204,685 |

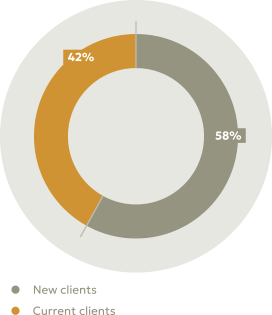

Number of clients by business size, units

13,234

By the end of 2023, the clients in the Company's portfolio were 13,234, which is 20.5% more than in 2022 (10,983 agricultural commodity producers). The predominant share is occupied by small and medium-sized businesses – 13,187 clients, which is about 99.6%.

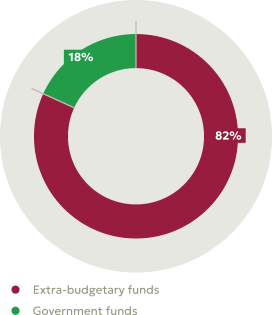

Leasing Structure by Financing Programs

| Program | Number of agreements | Number of equipment, units | Equipment value, mln KZT |

| "Master Leasing" | 438 | 905 | 52,493.9 |

| "Express Leasing" | 2,190 | 2,627 | 42,541.9 |

| "Made in Kazakhstan" | 429 | 479 | 17,049.5 |

| "Reliable Farmer" | 12 | 13 | 512.7 |

| "Preferential Leasing" | 295 | 333 | 15,162.9 |

| "Leasing of machinery and vehicles (VB)" | 1,002 | 1,334 | 37,131.2 |

| "Zhasyl Onim" | 122 | 139 | 2,267.9 |

| "Own Feed" | 1,694 | 1,880 | 10,828.6 |

| Total: | 6,182 | 7,710 | 177,988.5 |

Source: Company data

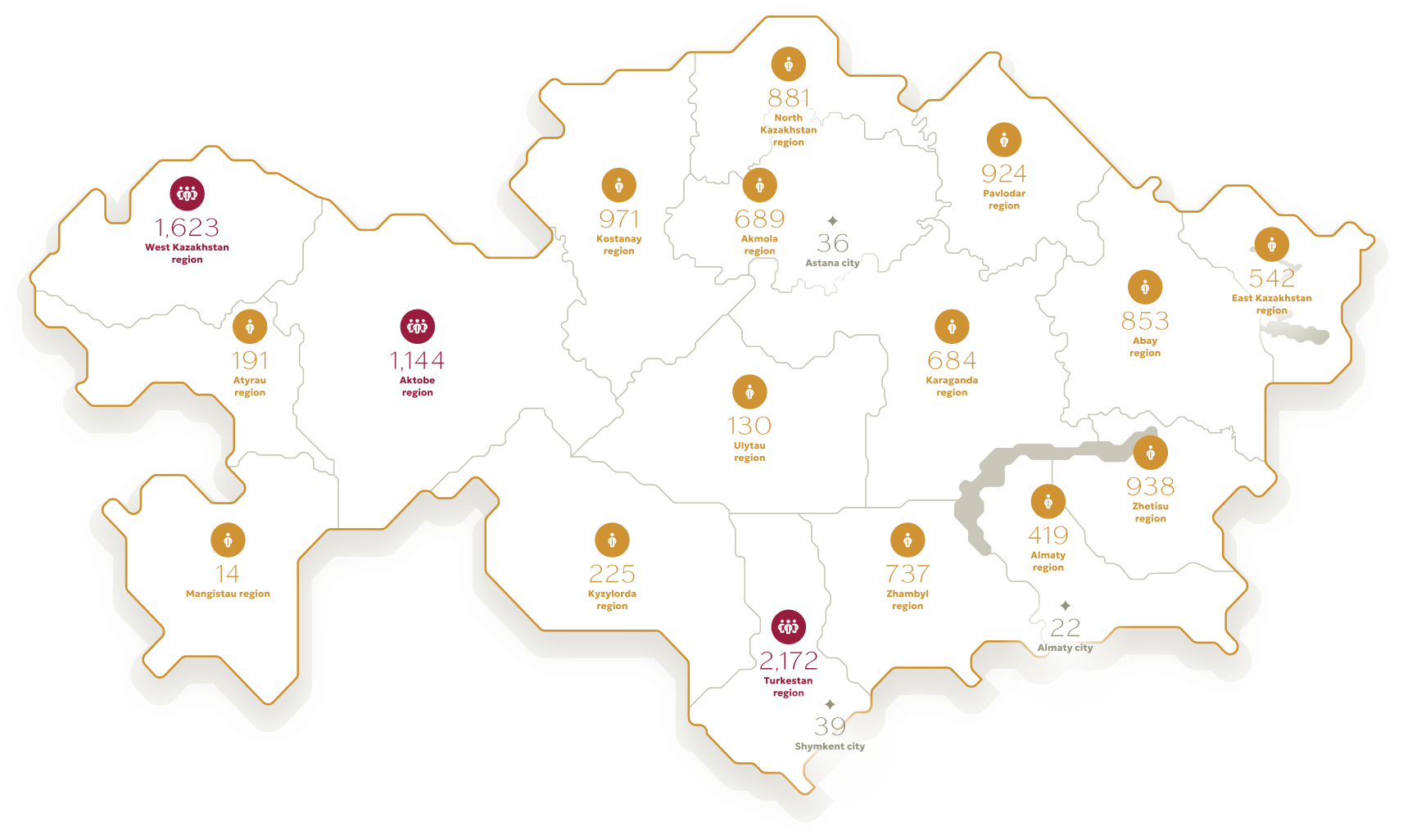

Structure of Clients

in the Portfolio

by Region in

2023

The Turkestan, West Kazakhstan and Atkobe regions have more than a thousand clients in the Company's regional client map.

Source: Company data

Financial

Results

Key Financial Indicators, mln KZT

| 2023 | 2022 | |

| Assets | ||

| Cash and cash equivalents | 43,801 | 64,764 |

| Funds from credit institutions | - | 62 |

| Loans to the clients | 8,111 | 13,287 |

| Finance lease receivables | 448,424 | 381,874 |

| Stocks | 3,043 | 2,870 |

| Fixed assets | 872 | 973 |

| Other assets | 19,052 | 10,512 |

| Total assets | 523,303 | 474,342 |

| Liabilities | ||

| Debt to the Shareholder | 17,641 | 22,062 |

| Debt to Baiterek NMH JSC | 12,424 | 11,584 |

| Funds of credit institutions | 34,081 | 30,638 |

| Debt securities issued | 210,268 | 206,717 |

| Government subsidies | 43,518 | 27,026 |

| Other liabilities | 19,802 | 19,365 |

| Total liabilities | 337,734 | 317,392 |

| Equity | 185,569 | 156,950 |

| ROA | 3.79 | 4.65 |

| ROE | 11.05 | 13.55 |

| Book value of one ordinary share (in KZT) | 1,800.48 | 1,889.28 |

| bln KZT | 2023 | 2022 | 2023 by 2022, % |

| Income, total | 72.7 | 59.0 | 123.28 |

| including: | |||

| Remuneration income | 71.5 | 58.1 | 122.98 |

| Expenses, total | 53.8 | 37.9 | 141.73 |

| including: | |||

| Remuneration expenses | 34.5 | 28.8 | 119.65 |

| Expenses for provision | 12.1 | 3.3 | 363.36 |

| CIT | 0.0 | 0.4 | 0.47 |

| Net income | 18.9 | 20.6 | 91.80 |

KazAgroFinance continues demonstrating positive financial performance, reflecting successful operations in the agricultural sector, financial stability and consistent development of the Company.