Corporate

Governance

The Company considers corporate governance as a means of increasing its performance, ensuring transparency and accountability, strengthening its reputation and reducing the costs of raising capital by them.

Components of the

corporate governance

system:

The Company corporate governance is based on the principles of fairness, honesty, responsibility, transparency, professionalism, and competence.

Honesty

The Company protects the rights of the Sole Shareholder and takes effective measures in case of violations of its rights;

Accountability

The Company ensures the accountability of the Company executive body to the Board of Directors and accountability of the Board of Directors to the Sole Shareholder;

Responsibility

The Company ensures recognition of the legal rights of the Sole Shareholder, encourages cooperation between the Company and the Sole Shareholder in matters of the financial well-being and stability of the Company;

Transparency

The Company ensures timely and reliable disclosure of information on all significant issues that may affect the decisions of stakeholders.

An established corporate governance system has been formed and is functioning in the Company, the necessary internal regulatory documents regulating the activities of the Company and its bodies have been developed and approved, the internal audit service is effectively functioning, assessing the internal control, risk management and corporate governance. The Company's management processes and procedures are structured in such a way as to ensure compliance with legislation, internal regulatory documents and create optimal conditions for making far-sighted and responsible decisions.

The KazAgroFinance supreme body is the Sole Shareholder, the management body is the Board of Directors, the executive body is the Board.

Corporate

Governance

Rating

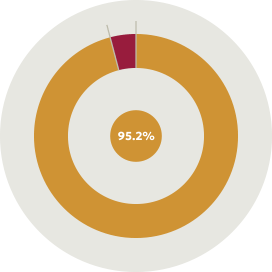

According to the results of the corporate governance diagnostics, an estimate of 95.2% was obtained, and the level of corporate governance meets the requirements of best practice.

Equity

Capital

Structure

Number of declared and placed ordinary shares of the Company as of December 31, 2023 is 102,837,204; the nominal value of the shares is 102,837,204,000 KZT. Change in the number of ordinary shares of the Company was caused by the decision of the Board of Directors dated May 2, 2023 No. 4 "On Increasing the Number of Declared Shares of KazAgroFinance JSC."

| Number of ordinary shares declared | 102,837,204 shares |

| Number of outstanding ordinary shares | 102,837,204 shares |

| Nominal value of one ordinary share, KZT | 1,000 KZT |

| Price for placement of one share, KZT | 1,000 KZT |

| Method of payment for the issuer's shares | the issuer's shares were paid in cash |

| Amount of funds raised from placement of the issuer's shares | 102,837,204,000 KZT |

Dividends

The Dividend Policy principles are set out by the Regulations on the Dividend Policy.

The dividends for 2022 were paid in June 14, 2023 in the amount of 10,309,686,954 KZT and 27 tiyn. The amount of dividends per ordinary share is 124 KZT 46 tiyn.

Dividends Paid

| Name | UoM | In 2021 (for 2020) |

In 2022 (for 2021) |

In 2023 (for 2022) |

| Net income (loss)* | thou KZT | 9,598,199 | 17,301,745 | 20,619,374 |

| Dividends declared during the year | thou KZT | 6,718,739 | 12,111,222 | 10,309,687 |

| Dividends paid during the year | thou KZT | 6,718,739 | 12,111,222 | 10,309,687 |

| Amount of dividend per share ** | KZT | 81.11 | 146.21 | 124.46 |

| Book value of the share *** | KZT | 1,339.89 | 1,774.30 | 1,889.28 |

* – Net income of the year for which dividends were paid.

** – Profit of the year for which the dividends were paid.

*** – Book value of the year for which the dividends were paid.

Anti-

Corruption

Activities

The Company's management and its employees adhere to the fundamental principles of openness and transparency in their work. The Company strives to ensure maximum publicity. First of all, this work is aimed to counter corruption and to prevent illegal actions by the Company’s employees.

Company’s Anti-Corruption Activities in the Reporting Year.

In accordance with the Kazakhstan Law “On Anti-Corruption” (the “Law”), the Company’s Compliance Service was transformed into Anti-Corruption Compliance Service, which functions shall include ensuring compliance of the Company and its employees with the Kazakhstan legislation on anti-corruption. If necessary, working groups are established to carry out anti-corruption activities and employees from other units are engaged in. In general, all the Company employees are involved in anti-corruption activities.

The Company implements the following anti-corruption measures:

- anti-corruption monitoring;

- internal analysis of corruption risks;

- development of anti-corruption culture;

- anti-corruption expert examination of internal regulatory documents of the Company;

- formation and observance of anti-corruption standards;

- acceptance of anti-corruption restrictions by employees, equivalent to those authorized to perform state duties;

- prevention and resolution of conflicts of interest;

- reporting of corruption offences, minor offenses;

- operation of the initiative reporting channels;

- checking the reliability of counterparties, inclusion of an anti-corruption clause in contracts with counterparties.