About

the Company

Mission

Technical and technological modernization of business of the Kazakhstan AIC entities.

Vision

KazAgroFinance JSC is a partner providing comprehensive client support in agriculture using digital solutions.

Purpose within the industry.Technological renewal of the agro-industrial complex by providing agricultural producers with accessible financial resources for the purchase of agricultural machinery and equipment on a lease basis.

Types of activities

- leasing activities in the agro-industrial complex;

- lending and other types of activities not prohibited by legislative acts that meet the Company’s goals and objectives provided for by the KazAgroFinance’s Charter;

- participation in implementation of republican budget and other programs aimed at the development of the agro-industrial complex.

Ratings

On September 26, the Fitch Ratings confirmed the long-term ratings of KazAgroFinance JSC in foreign and national currency at the level of "BBB-"; the outlook for the ratings is "Stable".

Licenses

License of the Agency of the Republic of Kazakhstan for Regulation and Supervision of Financial Market and Financial Organizations to bank lending operations in national currency (received on March 31, 2006).

Geography of Activity

There are 15 branches in all regions of the country. Cooperation with Kazakhstan equipment manufacturers, as well as suppliers from near and far abroad.

ISO 9001-2015 Quality Management System certification.

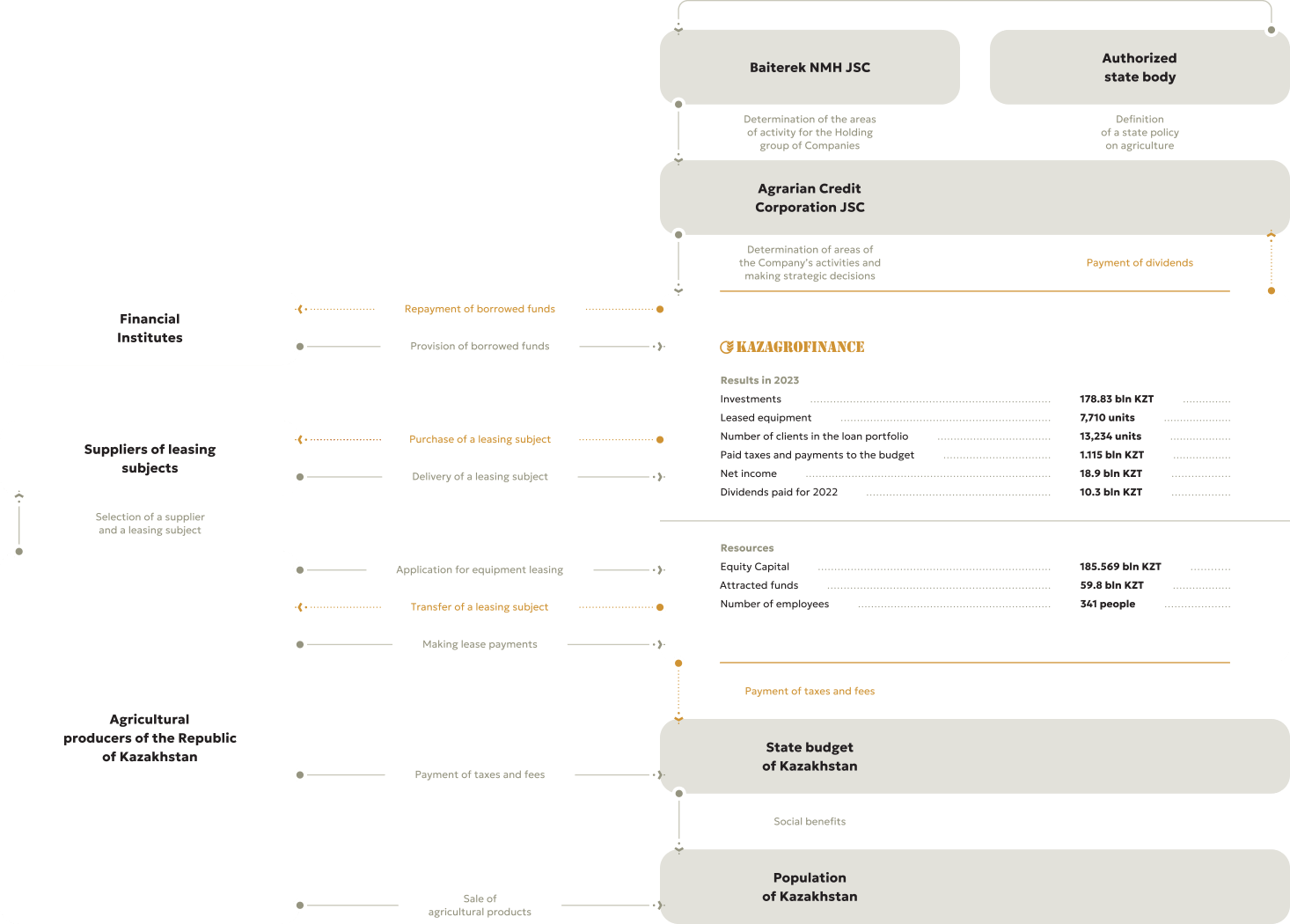

Model

Areasof

Activity

In 2023, the Company had the following programs:

- Leasing on standard terms:

- agricultural machinery (self-propelled, mounted and trailed);

- special equipment for land reclamation and agricultural work, including unmanned aerial vehicles;

- vehicles for the transportation of biological assets, agricultural and fish products, including freight cars;

- equipment (requiring and not requiring installation);

- Special financing programs:

- "Made in Kazakhstan";

- "Reliable Farmer";

- "Express Leasing";

- "Preferential Leasing";

- "Zhasyl Onim";

- "Own Feed".

- Special financing services:

- "Master Leasing".

Financing programs for the end of 2023

| Term | Advance | Rate | |

| Conditions and terms for standard leasing | |||

| Agricultural machinery | up to 10 years |

not less than 15% |

Base rate of the National Bank of Kazakhstan plus 7% (6% – including subsidies) |

| Special equipment for land reclamation and agricultural work | up to 7 years |

not less than 20% |

Base rate of the National Bank of Kazakhstan plus 7,5% (6% – including subsidies) |

| Unmanned aerial vehicles for agricultural needs | up to 5 years |

not less than 30% |

Base rate of the National Bank of Kazakhstan plus 7,5% (not subsidized) |

| Vehicles (including tractors and trailers) for the transportation of agricultural and fish products and products of their processing, biological assets | up to 7 лет |

not less than 15% |

Base rate of the National Bank of Kazakhstan plus 7,5% (6% – including subsidies) |

| Freight cars for transportation of grain and other types of agricultural products | up to 10 years |

not less than 15% |

Base rate of the National Bank of Kazakhstan plus 7,5% (not subsidized) |

| Conditions and terms of special financing programs | |||

| "Made in Kazakhstan" Domestically manufactured/assembled agricultural machinery and vehicles |

up to 10 years |

not less than 15% |

6% |

| "Preferential Leasing" Self-propelled domestically manufactured/assembled agricultural machinery |

up to 10 years |

from 0% |

6% |

| "Own Feed" Agricultural machinery, forage harvesting equipment and mobile irrigation systems |

up to 10 years |

not less than 15% |

6% |

| "Zhasyl Onim" Agricultural machinery, irrigation systems, special equipment, vehicles for the production and/or transportation of vegetables, fruits, berries, sugar beet |

up to 10 years |

not less than 15% |

6% |

| "Reliable Farmer" Leasing without advance payment |

up to 10 years |

0% | Base rate of the National Bank of Kazakhstan plus 7,5% (6% – including subsidies) |

| "Express Leasing" Without confirmation of income |

up to 10 years |

not less than 20% |

Base rate of the National Bank of Kazakhstan plus 7,5% (6% – including subsidies) |

| Conditions and terms of special financing services | |||

| "Master Leasing" Leasing line for 1 year |

up to 10 years |

not less than 15% |

Base rate of the National Bank of Kazakhstan plus 7,5% (6% – including subsidies) 6% |

The preferential terms for financing in a form of leasing are the provision of machinery without collateral, without paying fees, with a grace period, long-term financing, without an advance payment (due to investment subsidies of up to 15% of the cost of machinery). The interest rate is subsidized by the state; the final interest rate for the client is 6% per annum.

Leasing

Process